4+ sba 504 loan documentation checklist

Before sharing sensitive information make sure youre on a federal government site. The gov means its official.

Spark Loan Software Reviews 2022 Details Pricing Features G2

Some loan programs set restrictions on how you can use the funds so check with an SBA-approved lender when requesting a loan.

. The holding will call into question many other regulations that protect consumers with respect to credit cards bank accounts mortgage loans debt collection credit reports and identity theft tweeted Chris Peterson a former enforcement attorney at the CFPB who is now a law. Though Cadence Bank has distributed enough SBA-backed funds to make it on the SBAs 7a top ten list it only offers SBA loans to business owners in Alabama. The bank offers four different SBA-backed loan types.

When you get an SBA 504 loan you can expect to save on costs. The great majority of hospitals and most other health care providers and suppliers are small entities by meeting the Small Business Administration SBA definition of a small business in the service sector having revenues of less than 80 million to 415 million in any 1 year or being nonprofit organizations. HARRISBURG -- Data released by the Small Business Administration Tuesday reveals which Pennsylvania businesses and groups shared 5 billion in loans of under 150000 provided through the federal Paycheck Protection Program.

Provide money for home improvements and repairs through HOME. It was viewed 81 times while on Public Inspection. Enhanced Content - Developer Tools.

636a its microloan demonstration loan program Microloans authorized by section 7m of the Act 15 USC. Small Business Administration SBA financing is subject to approval through the SBA 504 and SBA 7a programs. Creating thriving school learning communities with ethical transformational leadership helps to promote diverse and equitable partnerships.

Small Business Administrations SBA loan program these have low rates that make them a great deal for real estate. Oct 15 2022 SBA LoansSBA loans are small business loans that are guaranteed by the Small Business Administration including the SBA 7 a 504 CAPLines Export Microloan and Disaster loan programs. Actual amortization rate and extension of credit are subject to necessary credit approval.

There are also 7a and 504 loans available through the small business administration. Bank loan savings and friendsfamily investment. Causa fortuita documento legal causas naturales when writing to claimants.

The 687 billion Activision Blizzard acquisition is key to Microsofts mobile gaming plans. The program provided those loans to 146000 state businesses an. Therefore for FY 2023 a final hospice payment update of 38 percent 41 percent less 03 percentage point will be applicable compared to 27 percent as proposed.

Currently SBA 504 loan interest rates are 466 for a 20-year loan and 449 for a 10-year loan. Bank of America credit standards and documentation requirements apply. You can also get a couple types of SBA real estate loans.

To be considered eligible for the SBA 504 loan. Hotel operators checklist to master flawless check-in From Cendyn CHECKLISTS TEMPLATES. SBA 7a loans and SBA 504 loans.

Loan terms collateral and documentation requirements apply. This part regulates SBAs financial assistance to small businesses under its general business loan programs 7a loans authorized by section 7a of the Small Business Act the Act 15 USC. A wide array of domestic and global news stories.

Federal government websites often end in gov or mil. Start your business in 10 steps. That means the impact could spread far beyond the agencys payday lending rule.

And unfortunately the other kinds of SBA loans dont qualify for loan forgiveness. Popular loan options for hotel businesses include SBA 7s and SBA 504 loans. Not limited to low income.

That includes SBA financing options like these. 636m and its. View printed version PDF Official Content.

Your lender can match you with the right loan for your business needs. An up-to-date SBA Form 2286 fillable version is available for digital filing and download below or can be found through the SBA website. This PDF is the current document as it appeared on Public Inspection on 12172020 at 845 am.

1201 Which loan programs does this part cover. These loans assist with financing for real estate inventory equipment business acquisition startup costs and partner buyouts. Loans guaranteed by SBA range from small to large and can be used for most business purposes including long-term fixed assets and operating capital.

Hidden costs may not appear right away or be listed in a checklist section on the loan documentation. Has the Minnesota Housing Fix Up Loan Program with up to 50000 depending on the type of project and up to 20 years term. Find over 500 grants and loans assistance programs in all states plus 2022 federal home improvement repair programs.

Startup business loans come in many forms. With a 504 loan you the SBA and a lender help contribute to the costs of the land purchase. Act law la Ley.

With online lenders big banks and credit unions all offering loans most credit profiles can qualify. Acknowledgement of Receipt of Notice of Hearing Form HA-504 Acuse de recibo de aviso de audiencia Formulario HA-504 ACPI Appeals Council Process Improvement el mejoramiento del proceso del Consejo de Apelaciones. SBA disaster loans outside of EIDL advances and grants If youve got one of these SBA loan types you have to repay your loan.

The best thing you can do is go through a commercial loan documentation checklist if youre preparing to apply for a small business loan. Business Lines of Credit. Microsoft is quietly building an Xbox mobile platform and store.

Because these are backed by the US. More information and documentation can be found in our developer tools pages. News topics include politicsgovernment business technology religion sportsentertainment sciencenature and health.

Low interest rates and long commercial real estate loan repayment termssome up to 25 years for real estate in the SBA 504CDC program. Act of God. We note that the final FY 2023 IPPS market basket growth rate of 41 percent would be the highest market basket update implemented in an IPPS final rule going back to FY 1998.

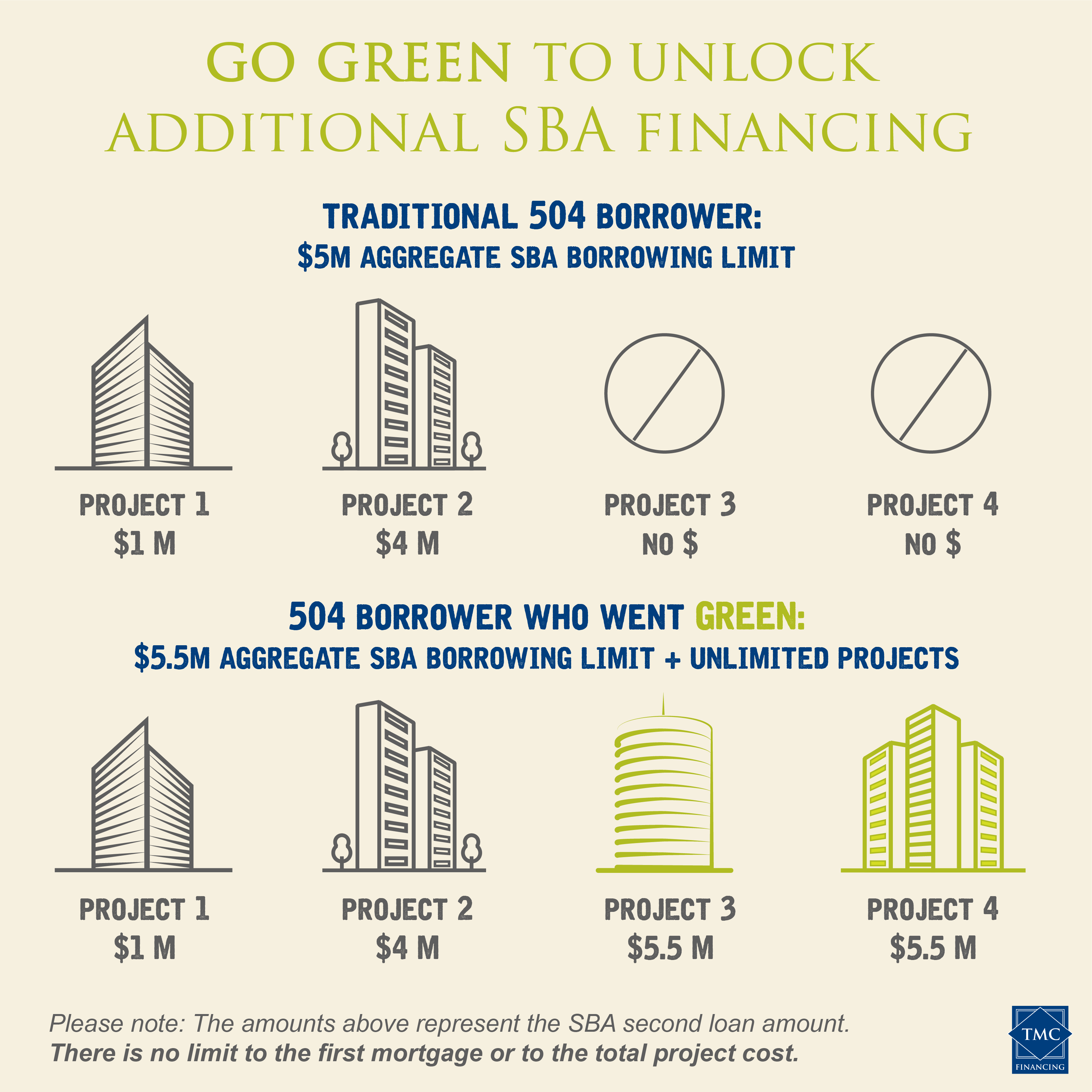

Top 3 funding sources. The SBA provides a loan for 40 percent of the purchase cost. The SBA 504 loan is a long-term fixed-rate loan designed to provide additional financing options for small businesses in need of expansion or an acquisition.

SBA reveals full list of recipients of PPP loans. A lender provides a loan for 50 percent. They can arise under.

Unlike other SBA loans the SBA 504 loan program offers lower up-front fees and fixed interest rates a huge bonus given the recent trend of rising interest rates. 7a loans up to 5 million Express loans up to 350000 504 loans no maximum amount given and CAPLines up to 5 million. Not sure where to start.

The manual shares figures and facts on how to best support minority families immigrant families students with an individual education plan IEP students with a 504 and gifttalented students.

Loan Processor Resume Samples Velvet Jobs

Who Are The Non Bank Sba Lenders In The Us Quora

Sba 504 Document Checklist First Bank Of The Lake First Bank Of The Lake

Application Checklist Sba 504 Loans

Sba 504 Document Checklist First Bank Of The Lake First Bank Of The Lake

Your Small Business Loan Document Checklist Guidant

Sba Form 2286 Download Fillable Pdf Or Fill Online 504 Debenture Closing Checklist Templateroller

Sba 504 Loan Application Checklist Pprdc

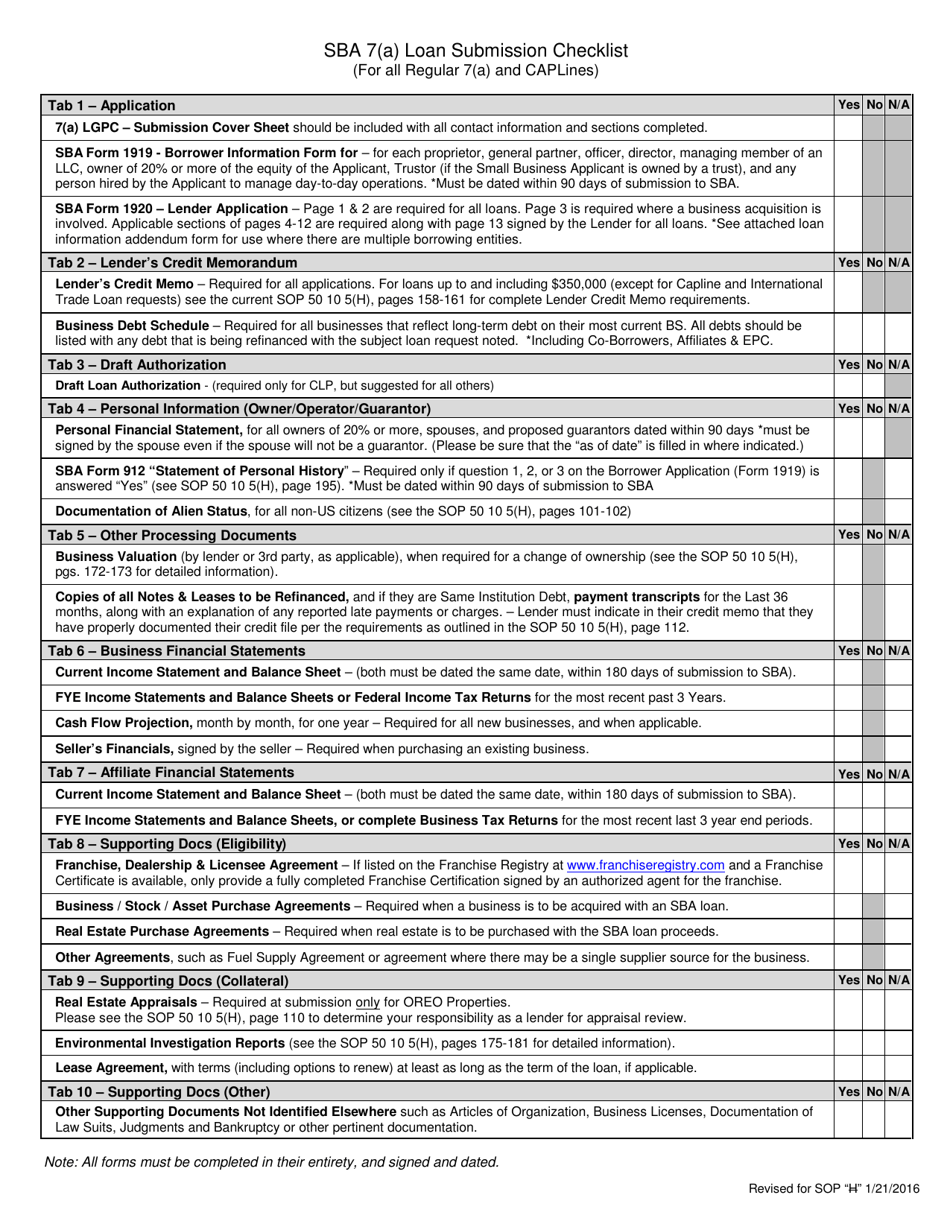

Sba 7 A Loan Submission Checklist For All Regular 7 A And Caplines Download Fillable Pdf Templateroller

Loan Documentation Specialist Job Description Velvet Jobs

Spark Loan Software Reviews 2022 Details Pricing Features G2

How Much Can I Get With An Sba Loan Tmc Gives You The Scoop

Is The Sba Bank Loan The Best Financing Option When Looking To Acquire A Sba Supported Business Quora

Sba 504 Document Checklist First Bank Of The Lake First Bank Of The Lake

Closing Checklist Sba 504 Loans

Sba Express Loan Application Checklist Sba Express Loans

Rebecca Parnell Savoy Vp Loan Operations Manager At Wells Fargo Minneapolis Minnesota United States Linkedin